Depreciations

The depreciation section in fleet master allows you to manage asset depreciation configurations, including creating new asset records, editing existing ones, and deleting outdated assets.

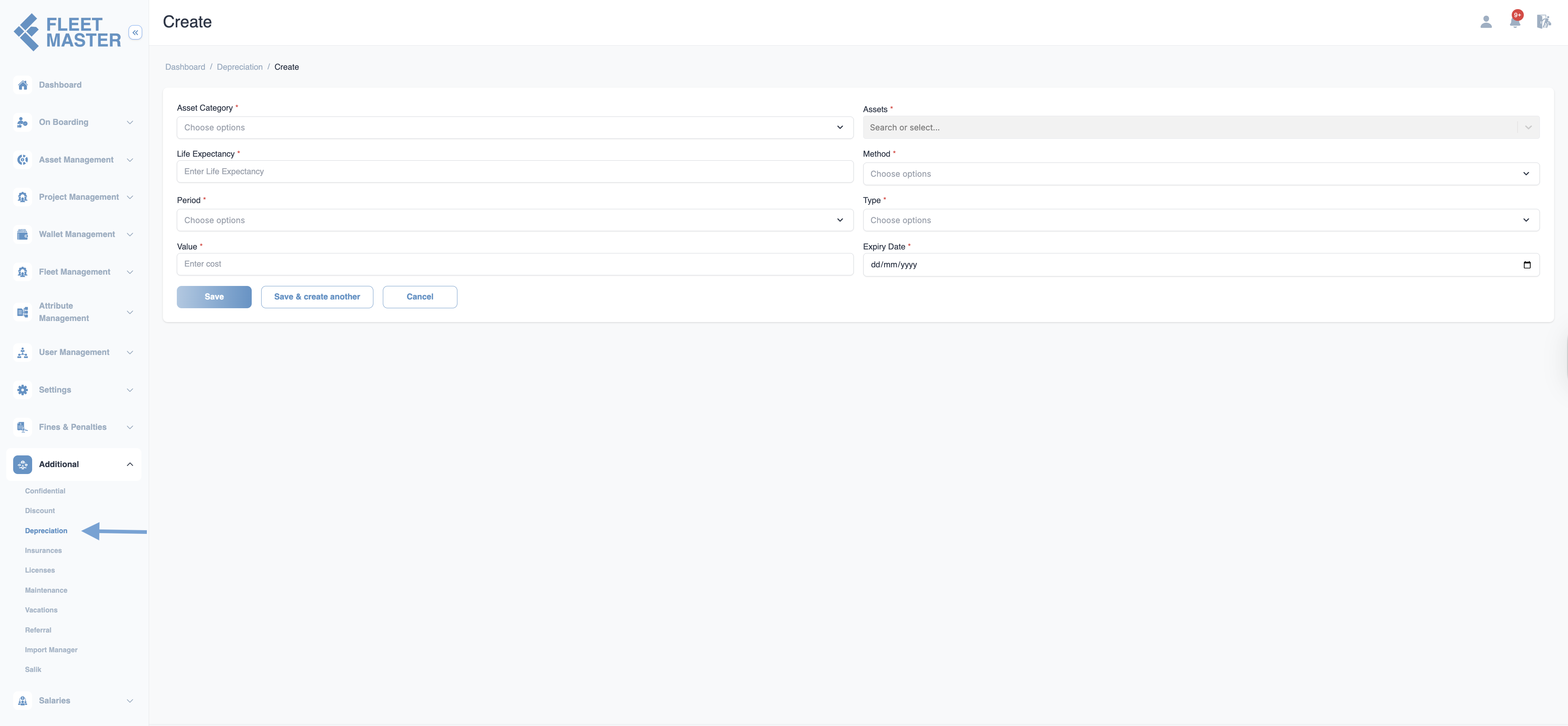

Creating a New Depreciation

To create a new depreciation record, click on the Create button. The Create Depreciation form includes the following fields:

- Asset Category:

Select the category of the asset (e.g., Vehicle, Uniforms, Sim Cards, Accessories). (Required) - Life Expectancy:

Enter the life expectancy of the asset in months or years. (Required) - Period:

Choose whether the depreciation will be calculated on a Monthly or Yearly basis. (Required) - Value:

Enter the initial cost or value of the asset. (Required) - Asset Type:

Select the type of depreciation—whether it's Fixed or Percentage. (Required) - Method:

Choose the method used to calculate the depreciation (e.g., Straight-Line Method, Declining Balance). (Required) - Expiry Date:

Set the expiry date for the asset depreciation calculation. (Required)

Editing & Deleting Depreciation

You can manage existing depreciation by following these steps:

- Go to the Depreciation section.

- To edit an asset depreciation configuration, click the Edit icon next to the asset entry. Update the depreciation details and save changes.

- To delete a depreciation configuration, click the Delete icon to remove it from the system permanently.

Best Practices

Proper Validation

Regularly validate asset depreciation configurations to ensure accuracy and avoid financial discrepancies.

Expiry Monitoring

Monitor the expiry dates of asset depreciation records to ensure they are updated or removed in time.