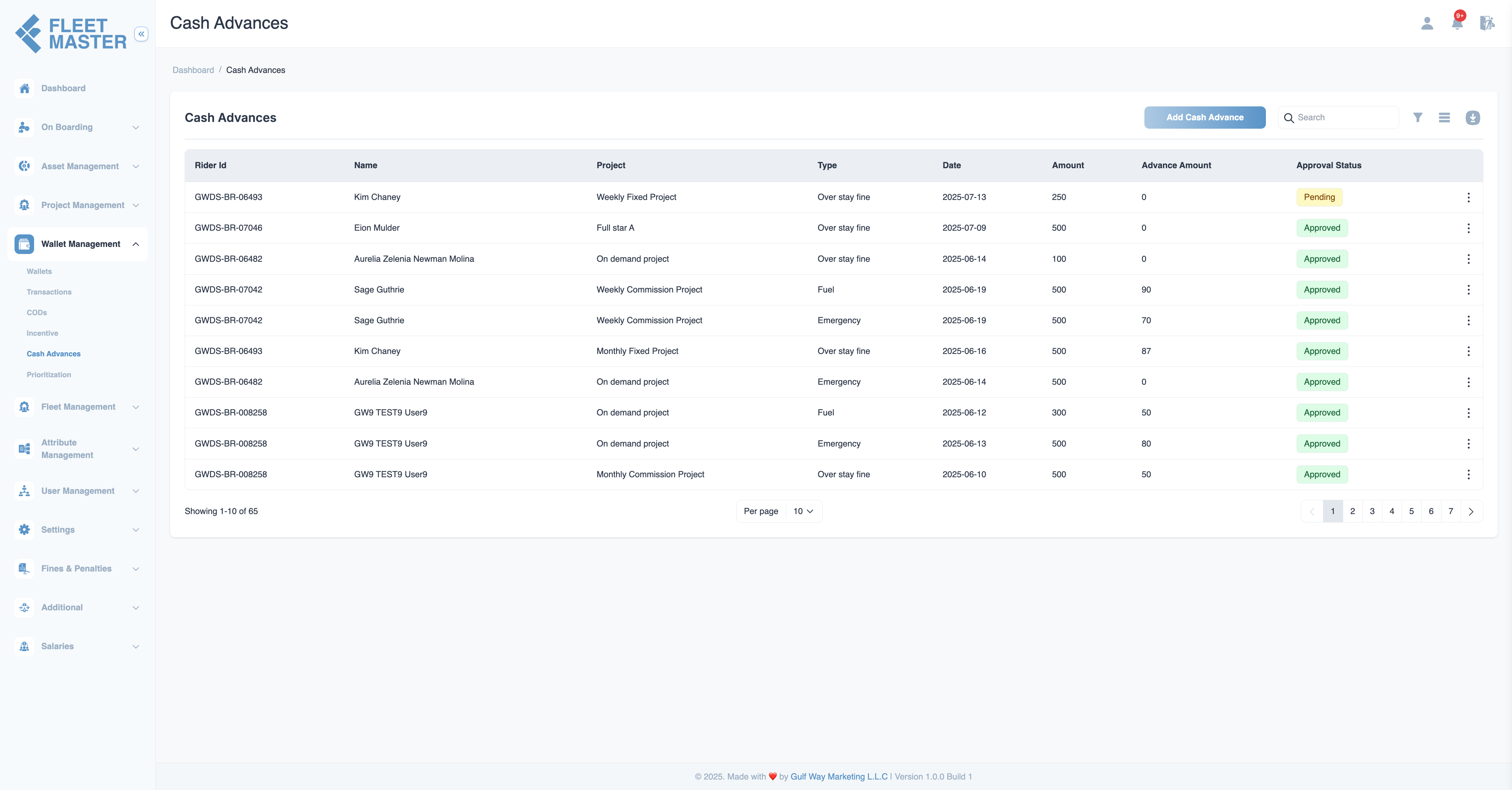

Cash Advances

Manage cash advances for fleets in fleet master, including how to create requests, link to projects, set installment plans, track approvals, and confirm transactions.

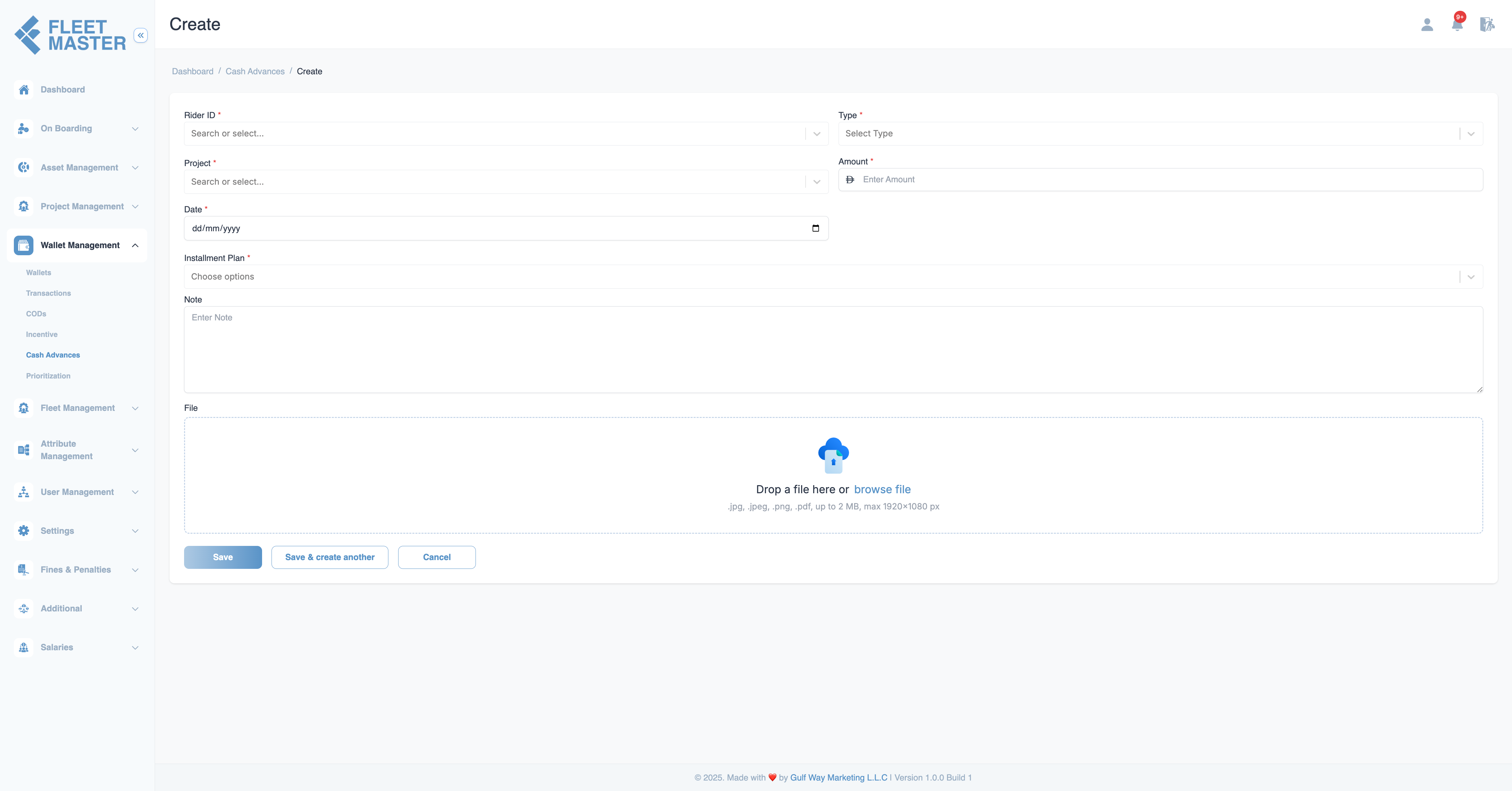

Creating a Cash Advance Request

To create a new cash advance request for a fleet, follow these steps:

-

Fleet ID: Select the fleet from the dropdown list. The selected fleet will be the recipient of the cash advance.

-

Project: Choose the project to which the advance is linked, if applicable.

-

Date: Set the date for the cash advance request.

-

Type: Select the type of cash advance, such as Fuel, Emergency Repairs, etc. These options are dynamically added via the attribute section in Fleet Master.

-

Amount: Enter the total amount of the requested cash advance.

-

Installment Plan: Choose the repayment plan for the advance. Available options include typical repayment schedules (e.g., 3 installments, 6 installments).

-

Note: Add any relevant remarks or context for the request, such as why the advance is needed.

-

File Upload: Attach any supporting documents, such as receipts or approval letters. Files can be uploaded in

.jpg,.png, or.pdfformats, with a maximum size of 2 MB.

Once all the required details are filled out, you can choose one of the following options:

- Save the request to complete it, or

- Save & Create Another to submit multiple requests in sequence.

Note:

Cash advances are subject to approval. Funds will only be disbursed and linked to the installment plan for salary deduction or manual payments after the advance is approved.

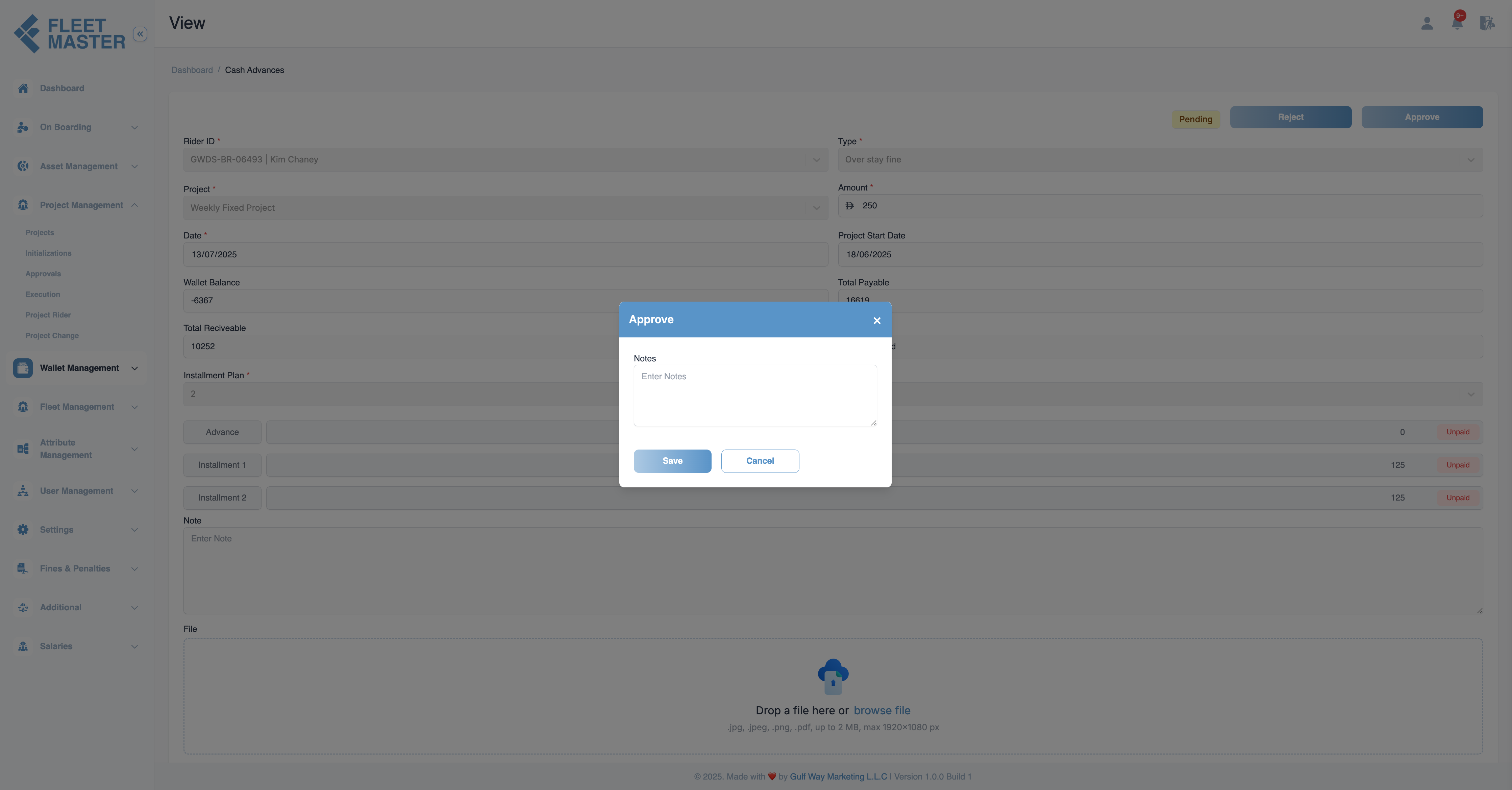

Cash Advance Payment Flow

After the cash advance is created, the following steps take place:

-

Approval Process:

- The cash advance request will be reviewed by an Admin or Compliance Officer.

- If approved, the advance will be processed, and the fleet will receive the requested amount.

-

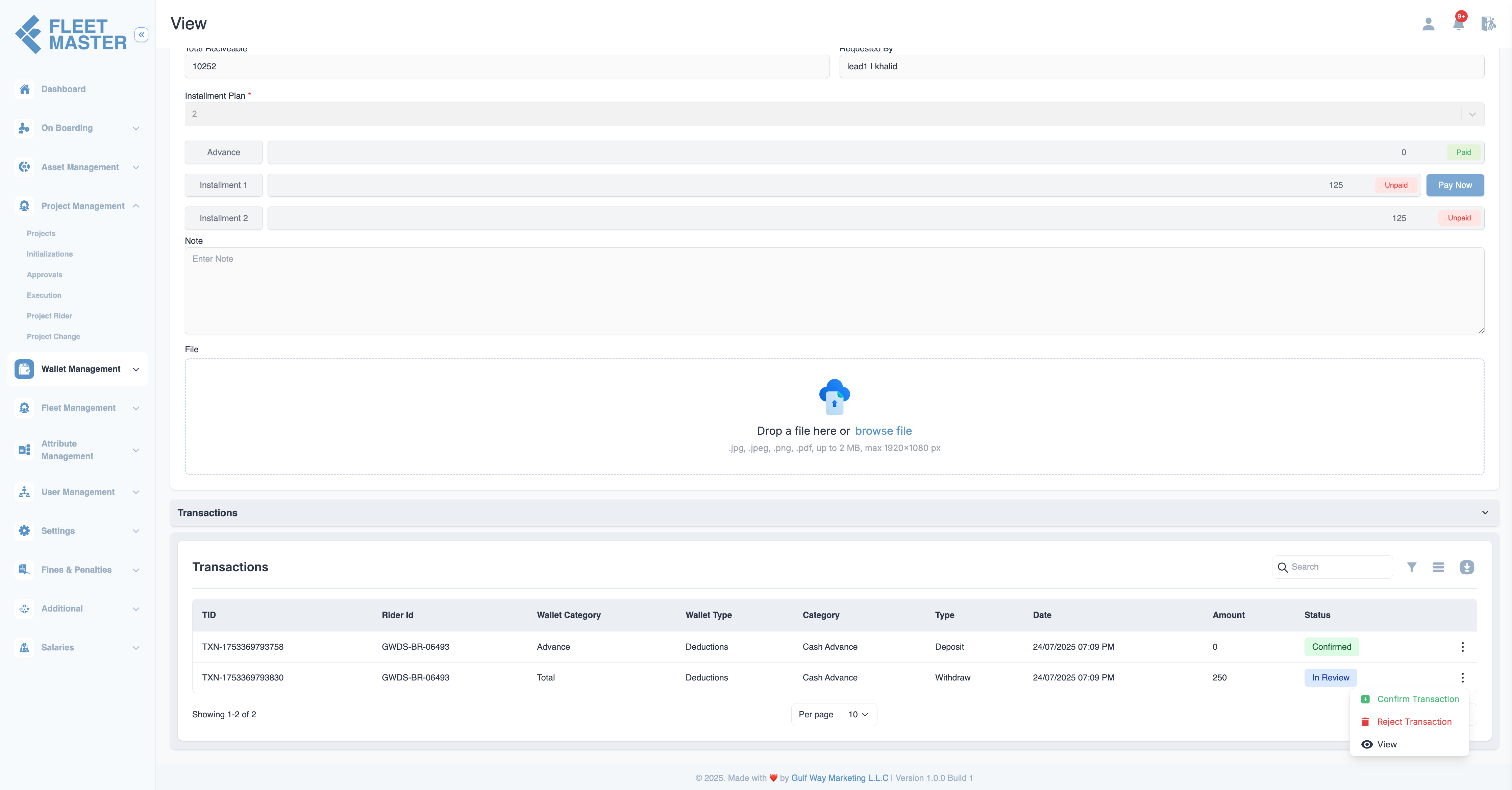

Installment Deduction:

-

If the fleet opts for automatic salary deduction, repayment will be divided according to the chosen installment plan.

Important:

The salary deductions for the cash advance will only start after the advance is paid upfront by the fleet or manually confirmed by the admin.

-

Alternatively, the fleet may choose manual payment via the Pay Now feature, allowing immediate repayment outside of salary deductions.

-

-

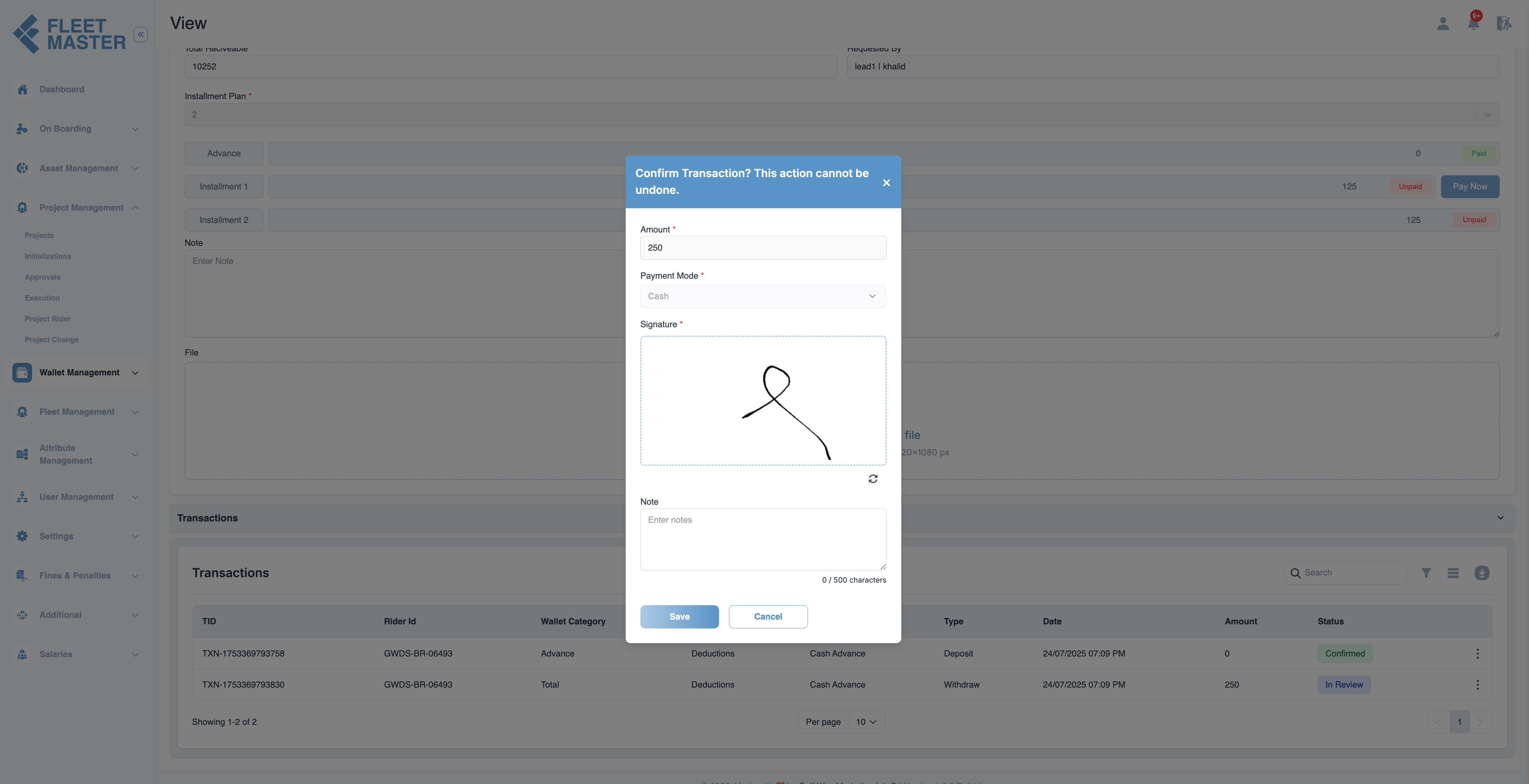

Transaction Confirmation:

After the cash advance is processed and the repayment method is selected, the transaction must be confirmed by an admin.- Each advance and repayment transaction will be listed in the Transactions section under Wallet Management.

- The status of each transaction will initially show as In Review until it is confirmed or rejected.

- An admin will need to confirm the transaction before it can be fully processed and marked as Paid.

After confirmation, the transaction status is updated, and the installment or manual payment details are reflected in the fleet’s account.

Managing and Confirming Cash Advance Transactions

In Fleet Master, all cash advance transactions are tracked in a detailed table under the Transactions section. The table includes:

- TID: Unique transaction ID.

- Fleet ID: The fleet associated with the transaction.

- Amount: The total amount of the cash advance or installment.

- Payment Type: Indicates whether the payment is an advance, installment, or manual payment.

- Status: Displays the current status of the transaction (e.g., In Review, Paid, Rejected).

- Installment Plan: Shows the number of installments if the cash advance is being paid in installments.

- Confirmation Status: Whether the transaction is confirmed or still under review.

Note:

The transaction will remain in the In Review state until an admin confirms or rejects it. Manual confirmation is required to finalize the transaction.

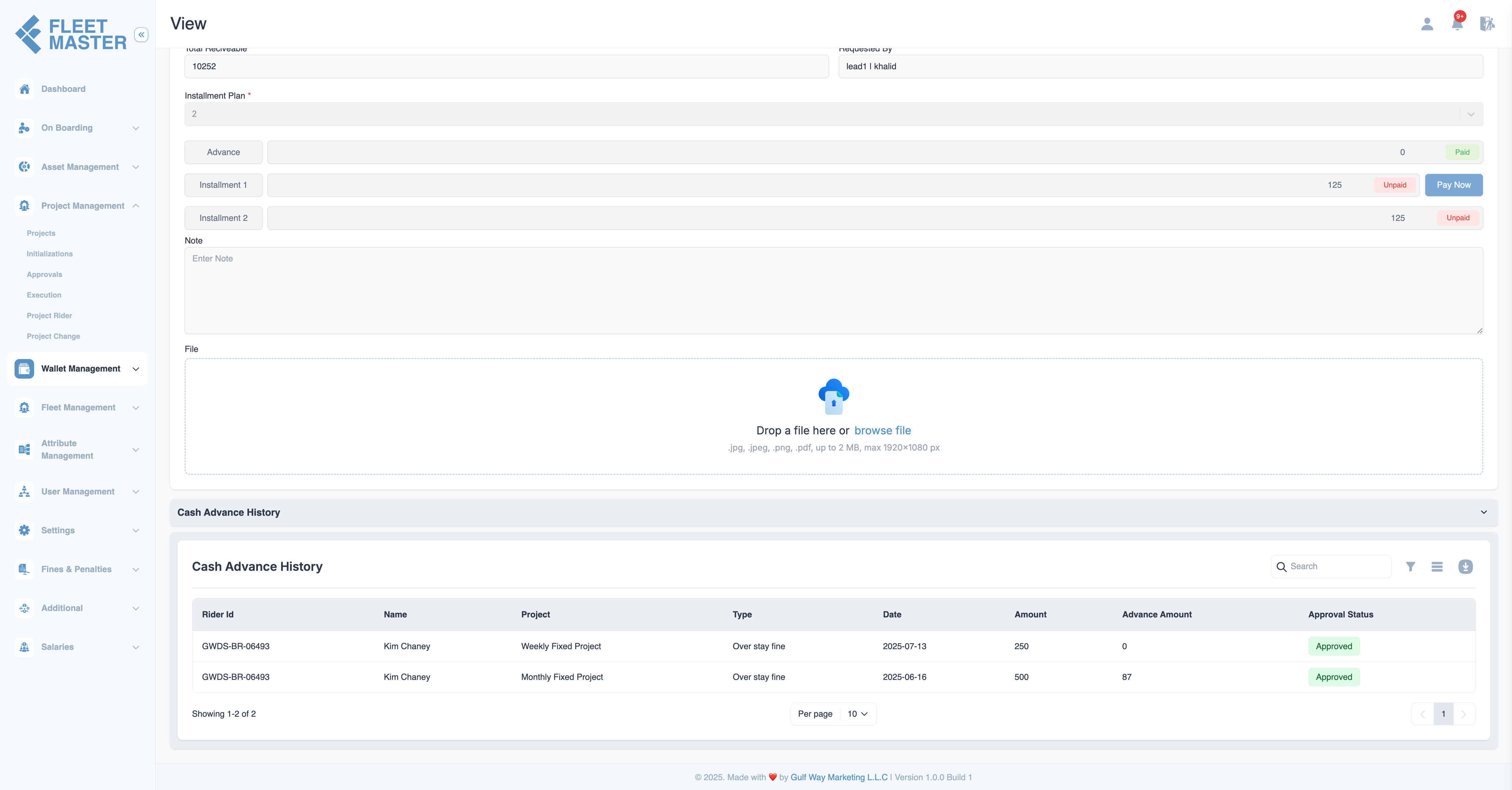

History

The History section records all activities related to the cash advance for each fleet. This helps admins and fleet managers monitor the fleet’s cash advance requests, approval statuses, repayments, and transaction history over time.

Benefits of the Cash Advance History

- Monitor Fleet Activity: Provides a comprehensive overview of each fleet's cash advance history, allowing easy tracking of requests and repayments.

- Transaction Transparency: Offers full transparency of the entire cash advance process, from request to approval and repayment, ensuring all parties involved have access to accurate data.

- Audit Trail: Keeps a digital record of all activities related to cash advances, helping maintain financial integrity and compliance.

Best Practices for Managing Cash Advances

-

Approval Workflow:

Ensure that each request goes through an approval process to prevent unauthorized advances from being processed. -

Installment Plan:

Clearly define a repayment schedule to ensure no confusion when processing payments. -

Document Upload:

Attach relevant proof of the requested amount or the reason for the cash advance to maintain accurate records. -

Transaction Confirmation:

Regularly review the Transactions table to confirm the status of each advance and repayment. Transactions should be confirmed promptly to keep records up to date. -

Regular Monitoring:

Regularly review and confirm payments to ensure accurate and up-to-date financial records.