Fines

Manage vehicle-related fines in fleet master, including how to add, split into installments, track violations linked to assets, and process advance payments.

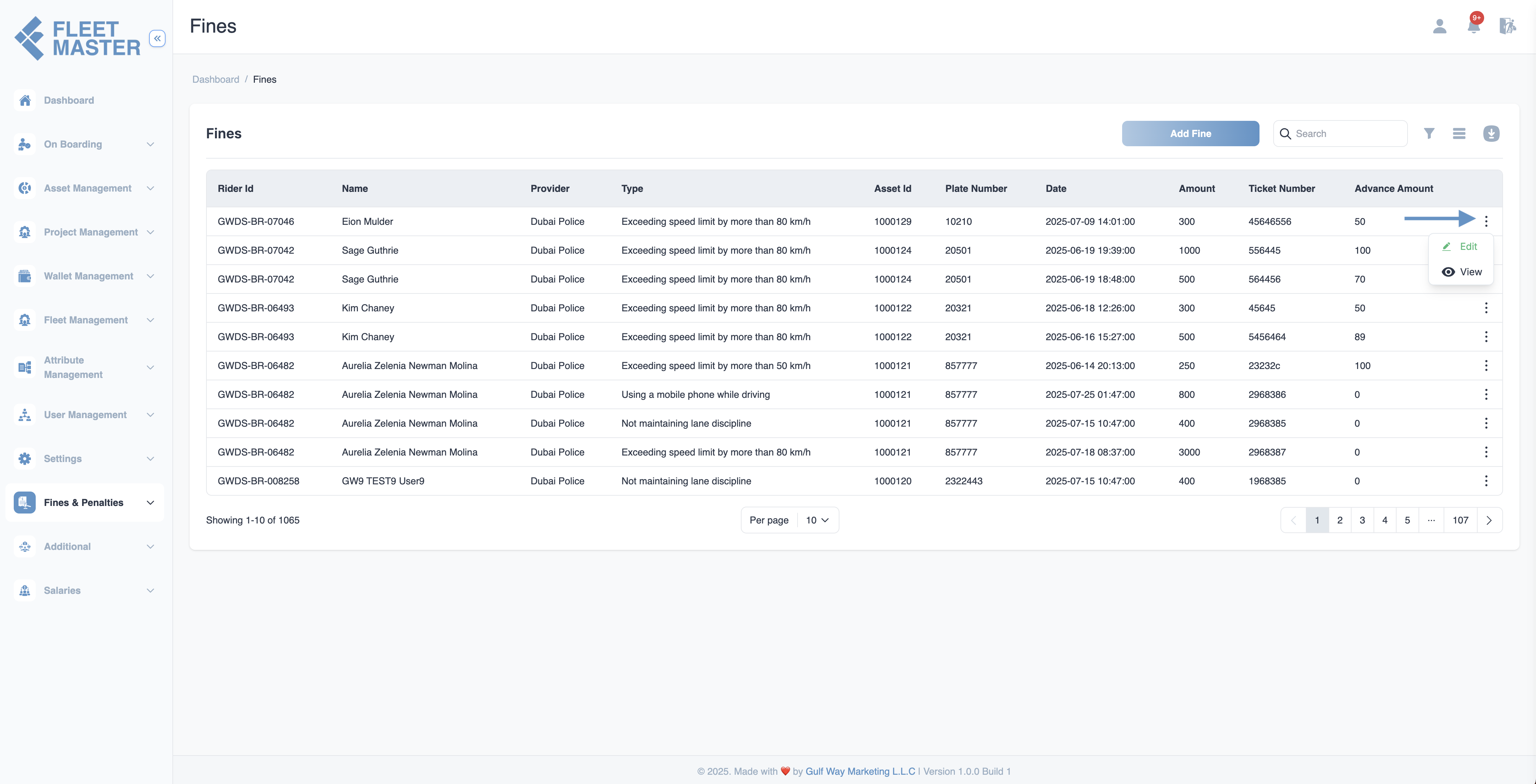

Viewing and Managing Fines

- Navigate to the Fines & Penalties section in the sidebar.

- You'll see a table listing all fines with key details:

- Fleet ID and Name

- Provider (e.g., Dubai Police, RTA)

- Type (based on asset-linked violations)

- Asset ID and Plate Number

- Date, Amount, Ticket Number

- Advance Amount, if any

- Use the search bar to filter fines or click Add Fine to create a new one.

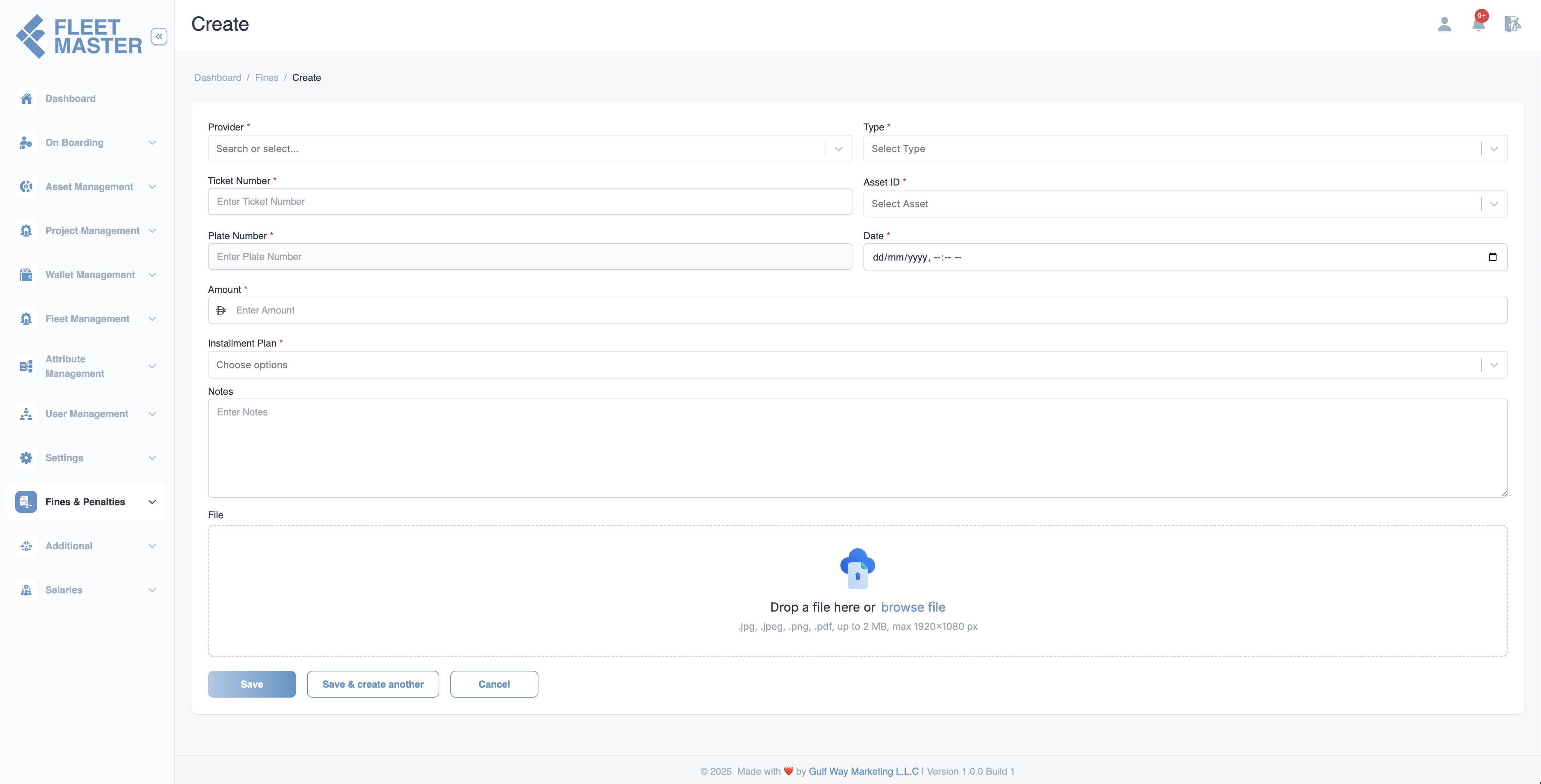

Adding a Fine

When adding a fine:

- Click Add Fine.

- Fill out the following fields:

- Provider: Select from available sources (Police, RTA, etc.).

- Type: Violation type (automatically loaded based on the asset).

- Ticket Number: Enter the fine or ticket reference.

- Asset ID: Select the vehicle involved in the fine.

- Plate Number: This is automatically tied to the selected asset.

- Date: Fine issue date.

- Amount: Total fine amount.

- Installment Plan: Choose how the amount should be paid.

- Notes: Optional remarks.

- File Upload: Attach any relevant documents (.jpg, .png, .pdf; max 2 MB).

Note:

The Plate Number belongs to the selected Asset ID. The fine will be assigned to the fleet currently responsible for that asset. This ensures accurate tracking and accountability for the fine payment.

Click Save or Save & Create Another to submit.

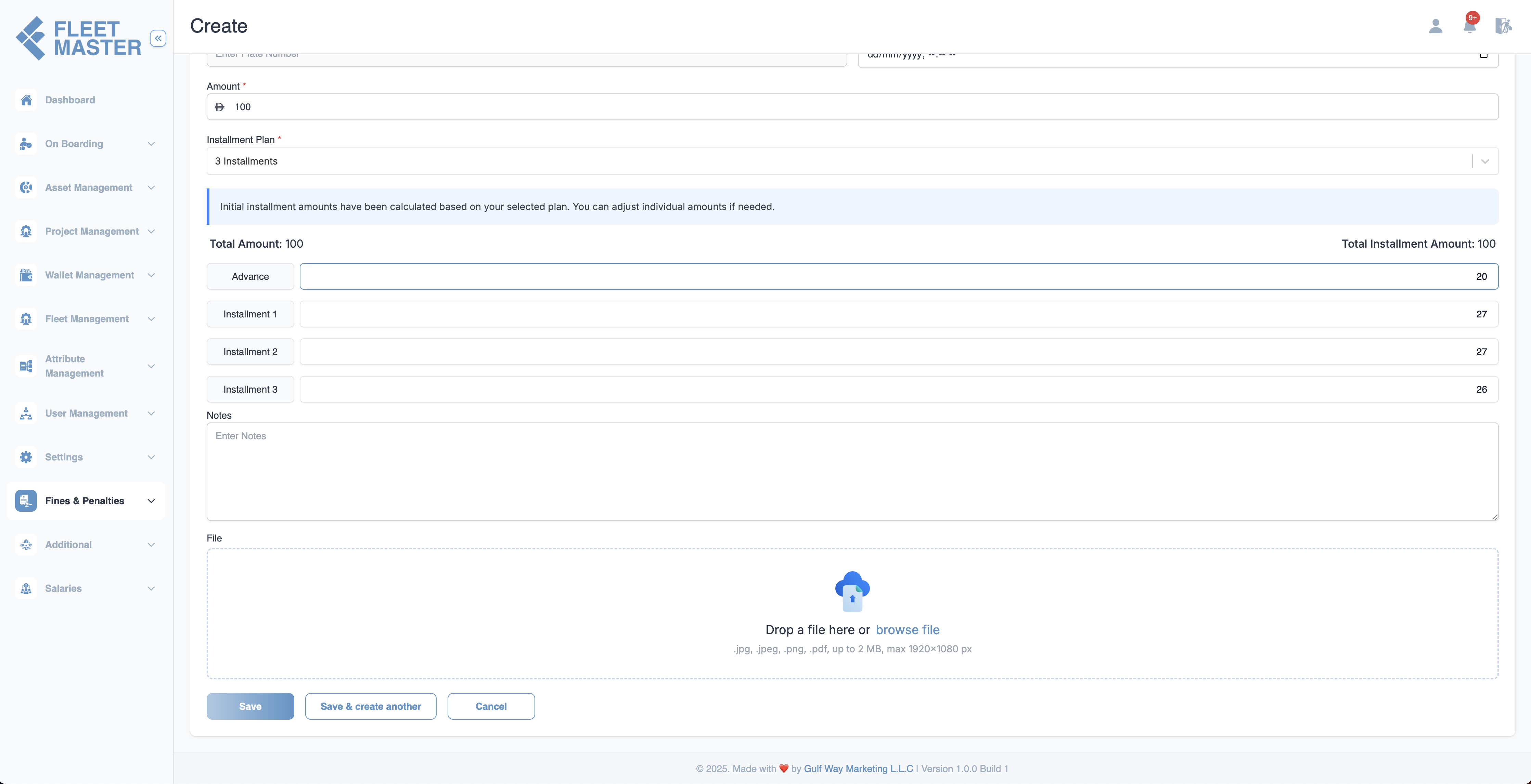

Installment Plans

If a fine is to be paid in parts:

- Enter the total Amount.

- Select an Installment Plan (e.g., 3 Installments).

- The system auto-splits the fine into equal parts.

- Advance is set to

0by default.- If you enter an advance, the rest is evenly split.

Important:

If an advance amount is entered, it must be paid upfront and manually before any salary-based installment deductions begin.

Payment Methods for Installments

There are two ways to pay installments:

1. Automatic Salary Deduction (Default)

By default, installment amounts are automatically deducted from the fleet's salary according to the payment schedule.

Advance Payment Requirement:

If an advance amount is specified, it must be paid manually and in full before installment deductions can start. The advance will not be deducted from salary automatically.

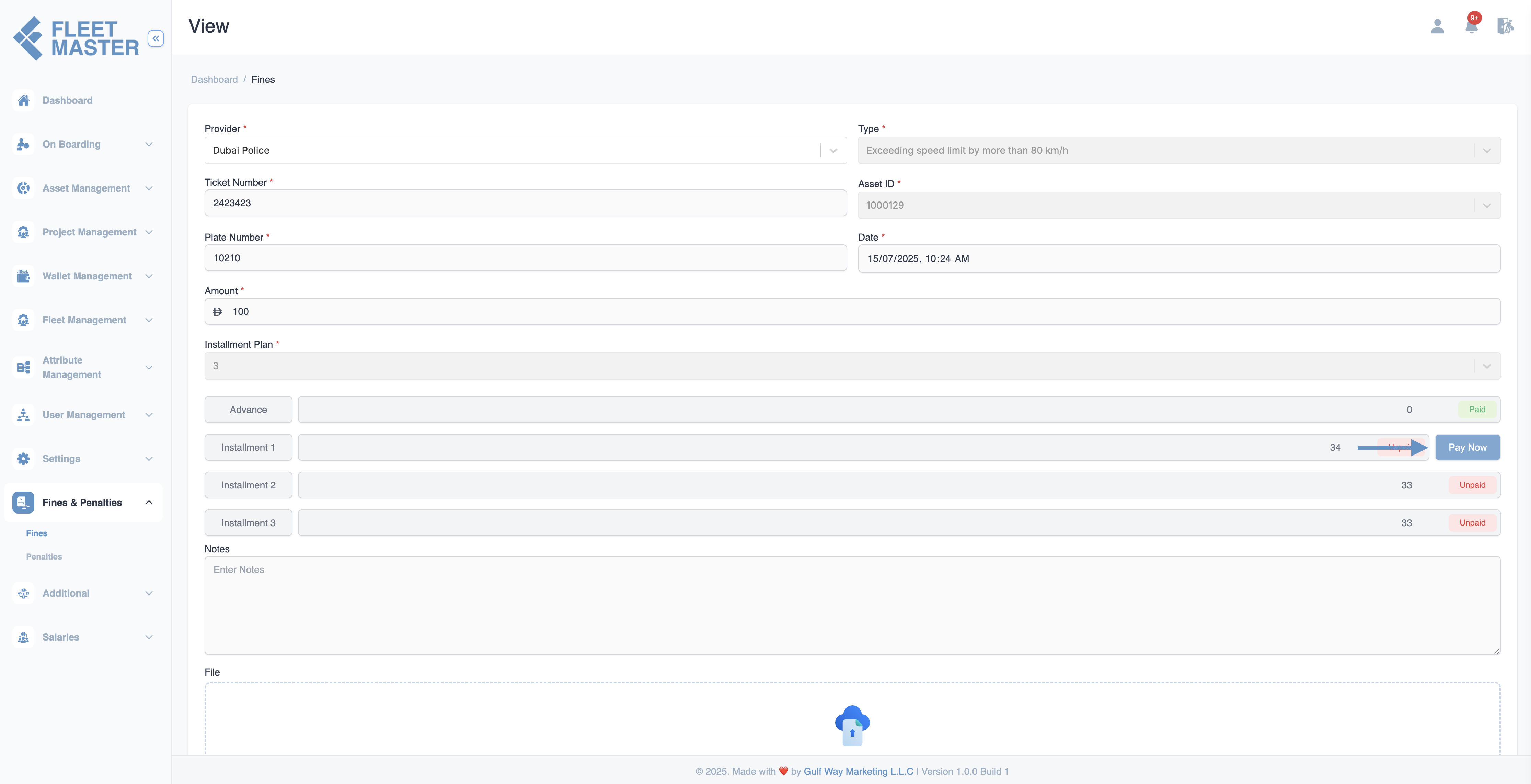

2. Manual Payment via "Pay Now" Button

If a fleet wants to pay an installment immediately without waiting for salary deduction:

3. How Manual Payment Works

-

Navigate to Fine View: Go to the fine's View page where you can see all installment details.

-

Sequential Payment: The Pay Now button appears on the right side of the first unpaid installment only.

- You cannot skip installments - they must be paid in order (1st → 2nd → 3rd, etc.)

-

Payment Process:

- Click the Pay Now button next to the current installment

- A "Make Payment" modal will popup

- Fill in the payment details:

- Mode of Payment: Select payment method (Cash, Bank Transfer, etc.)

- Amount: Pre-filled with the installment amount

- Note: Optional payment remarks

- Click Save to submit the payment

-

Payment Confirmation:

- The payment goes to "In Review" status in the Transactions section

- An admin must confirm or reject the transaction (similar to advance payments)

- Once confirmed, the installment shows as "Paid"

-

Next Installment: After confirmation, the Pay Now button automatically appears on the next unpaid installment.

Payment Flow Example:

Initial State:

- Installment 1: Shows Pay Now button

- Installment 2: No button (locked)

- Installment 3: No button (locked)

After paying Installment 1:

- Installment 1: Shows "Paid" status

- Installment 2: Shows Pay Now button

- Installment 3: No button (still locked)

After paying Installment 2:

- Installment 1: "Paid"

- Installment 2: "Paid"

- Installment 3: Shows Pay Now button

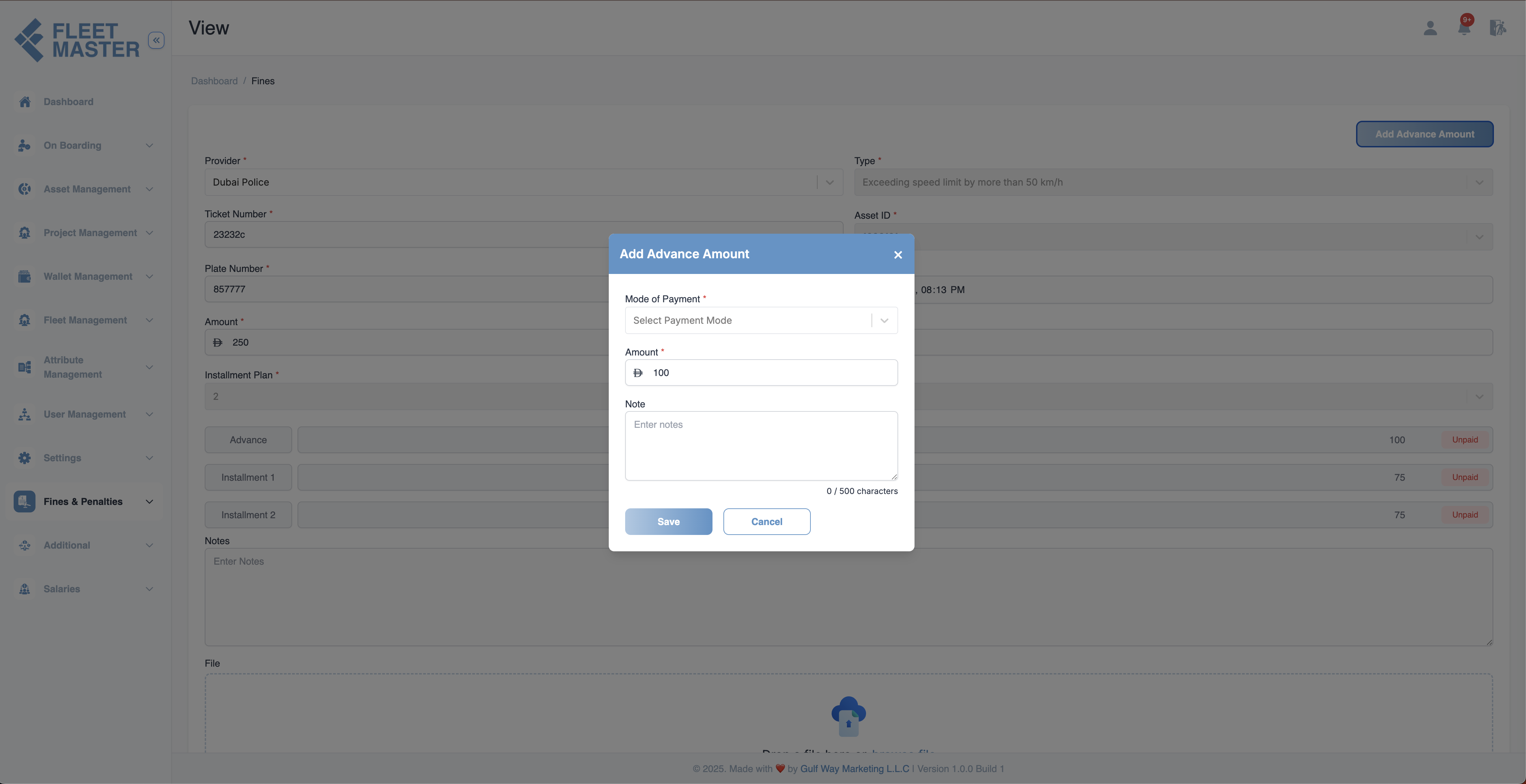

Processing Advance Payments

When viewing a fine with an unpaid advance amount:

Adding Advance Payment

- Navigate to the fine's View page.

- If the advance payment is unpaid, you'll see an Add Advance Amount button.

- Click the button to open the advance payment modal.

- Fill in the payment details:

- Mode of Payment: Select payment method (Cash, Bank Transfer, etc.)

- Amount: Pre-filled with the advance amount (e.g., 100)

- Note: Optional payment remarks (500 character limit)

- Click Save to process the payment or Cancel to abort.

Note:

Advance payments are mandatory upfront and must be paid manually. The system will not process installment deductions until the advance is paid and confirmed.

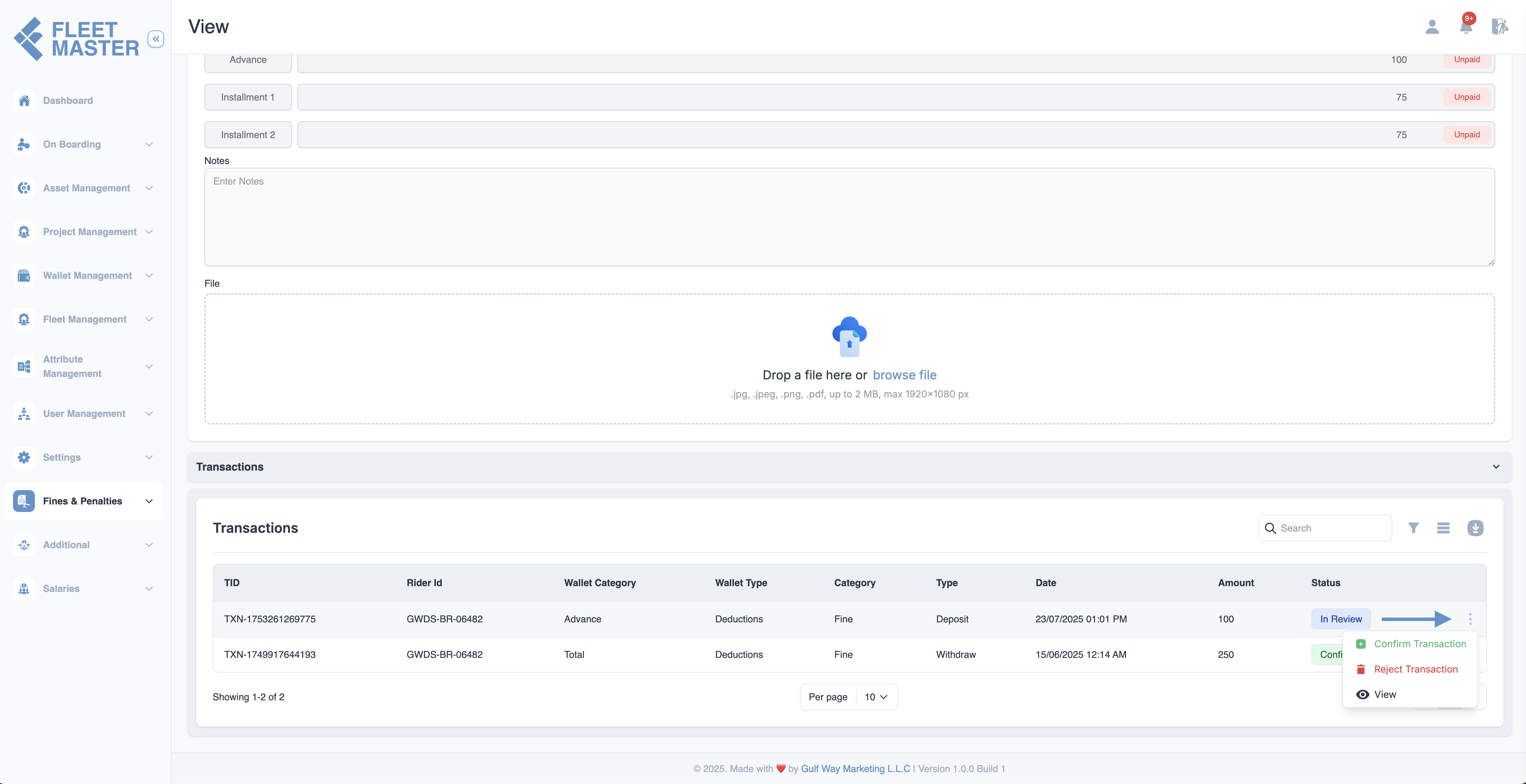

Payment Confirmation

Once any payment (advance or installment) is saved:

- The payment status updates to "In Review"

- A new transaction record is created in the Transactions section

- An admin must confirm the transaction before it's finalized

In the transactions interface, you can manage payment confirmations through a dropdown menu with three key options:

- Confirm Transaction: Approves and finalizes the payment

- Reject Transaction: Declines the payment and reverts the status

- View: Opens detailed transaction information

Viewing Transaction Records

- Navigate to Transactions in the main menu.

- Find the payment transaction with:

- TID: Transaction ID (e.g., TXN-175326126975)

- Fleet ID: Associated fleet

- Wallet Category: Advance or Installment

- Type: Deposit

- Status: In Review (pending confirmation)

- Use the action menu to:

- Confirm Transaction

- Reject Transaction

- View transaction details

Important:

All manual payments (advance and installments) require confirmation in the Transactions section before being fully processed. Transactions remain "In Review" until an admin confirms or rejects them.

Best Practices

- Always link fines to the correct Asset ID to maintain record accuracy.

- Use Installment Plans for large amounts to simplify fleet repayments.

- Manual payments are processed one-by-one in sequential order - fleets cannot skip ahead.

- Advance payments must be paid manually and confirmed before installments begin.

- Upload scanned tickets or fine documents to maintain a digital audit trail.

- Process advance and installment payments promptly to maintain accurate financial records.

- Regularly review and confirm transactions to ensure proper payment tracking.

- Monitor both salary deductions and manual payments to avoid double-charging fleets.

Tip:

Fine types are dynamically linked to asset-related attributes. Ensure assets are configured properly for accurate type listings. Fleets can choose to pay installments immediately via "Pay Now" or let them be automatically deducted from salary (after advance is cleared).

Security Best Practice:

Limit fine addition, editing, and deletion permissions to admins or compliance officers to maintain audit accuracy and prevent tampering. Similarly, restrict transaction confirmation rights to authorized personnel only. Ensure proper approval workflows for all manual payments.