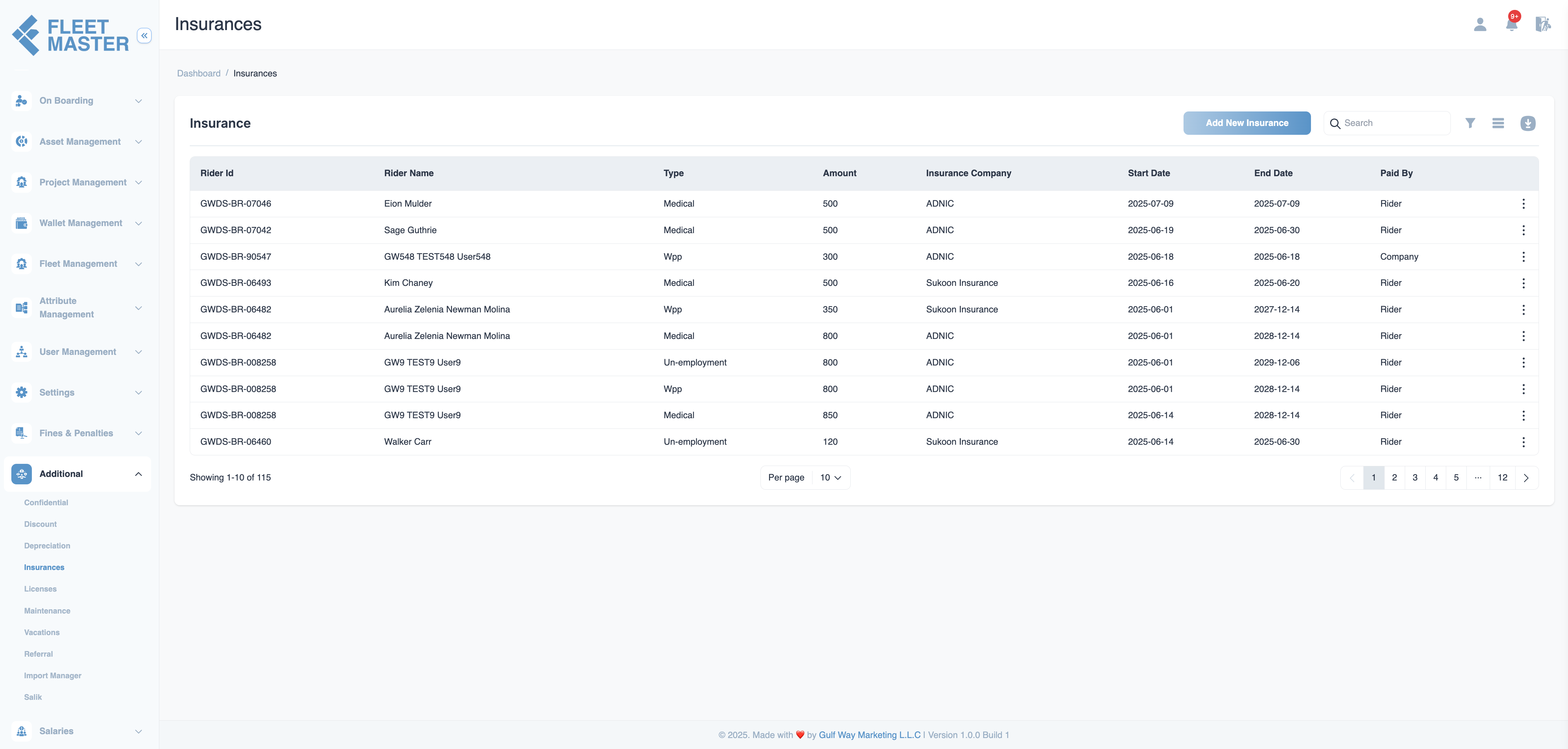

Insurances

Manage dynamic insurance types, including WPP, Medical, Unemployment, ILOE, and Workmen Compensation in fleet master. Handle transactions, advance payments, installment deductions, and restrictions on editing insurance information after payments.

Insurance Types & Companies

-

Insurance Type Options:

- WPP (Worker Protection Program)

- Medical

- Unemployment

- ILOE (Income Loss of Employment)

- Workmen Compensation

-

Insurance Company:

- Insurance companies can be dynamically selected from the Attribute Management section, providing flexibility in choosing different providers.

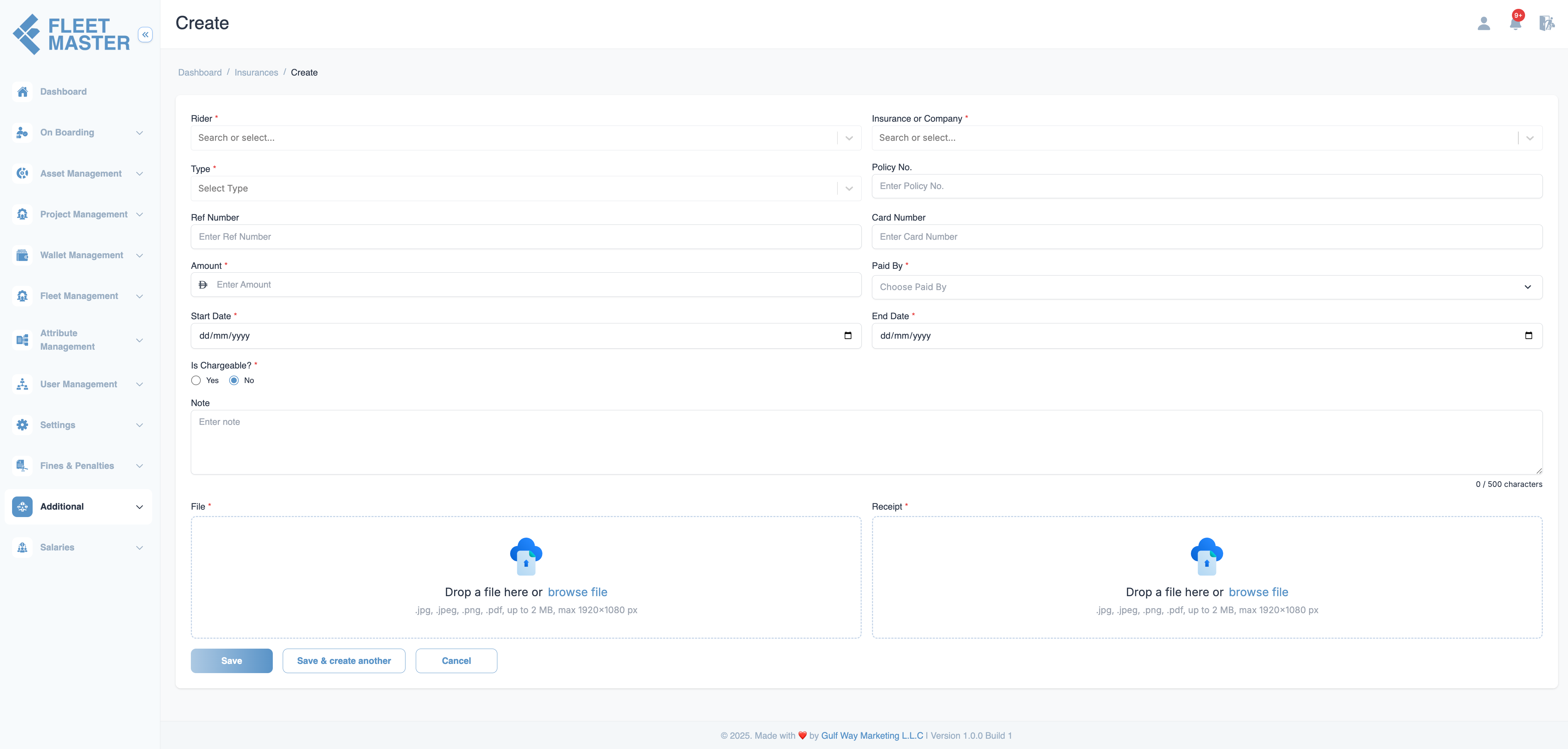

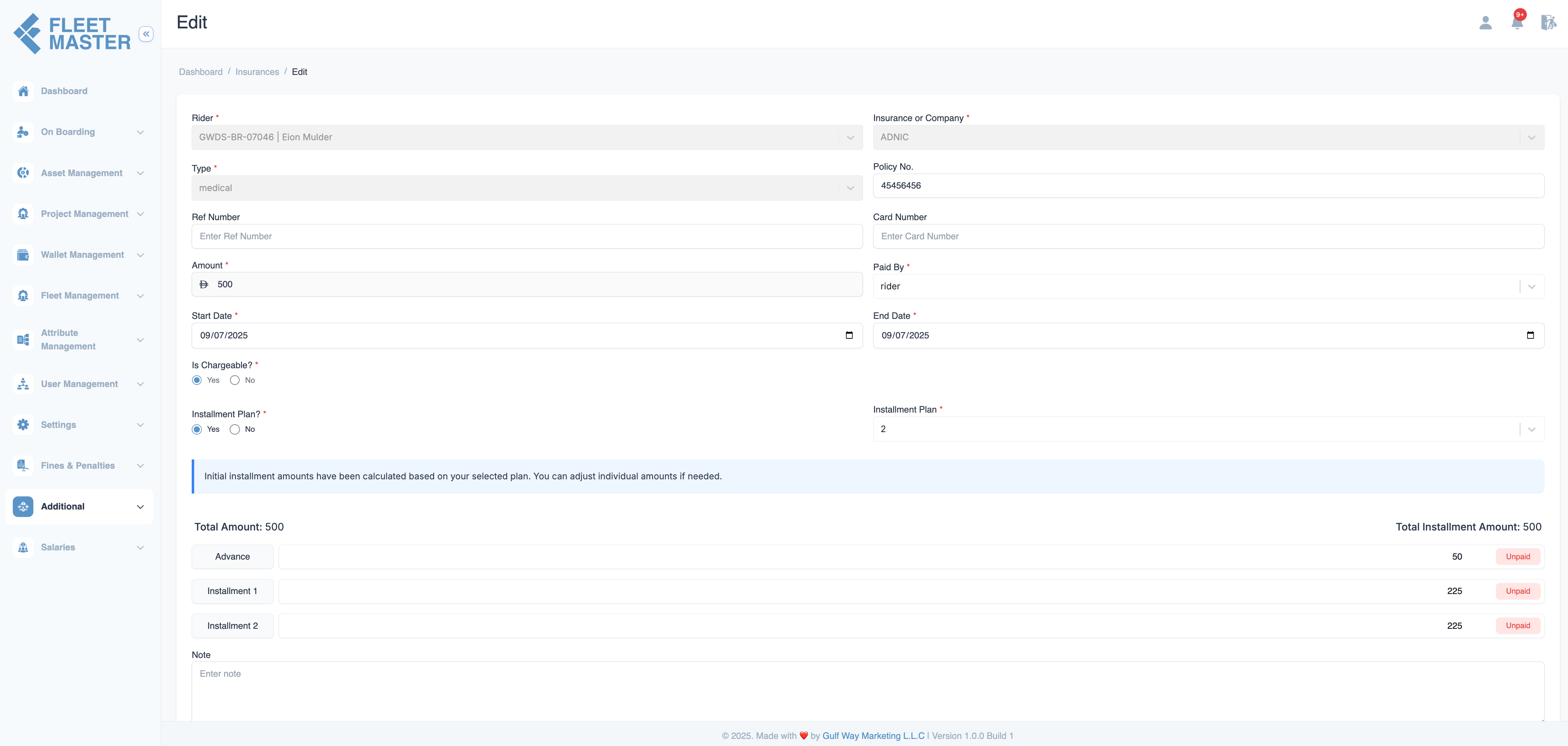

Creating an Insurance Entry

- Navigate to Additional > Insurances and click Create.

- Fill in the following fields:

- Fleet: Select the specific fleet associated with the insurance.

- Insurance Type: Choose from the dynamic list (WPP, Medical, Unemployment, ILOE, Workmen Compensation).

- Insurance or Company: Select the insurance provider (dynamically added via Attribute Management).

- Ref Number: Enter the reference number.

- Policy Number: Enter the insurance policy number.

- Card Number: Enter the card number (if applicable).

- Paid By: Choose whether it's paid by the company or the fleet.

- Amount: Enter the total amount of the insurance.

- Installment Plan: Choose the number of installments (e.g., 3 installments).

- Is Chargeable: Select

YesorNo.

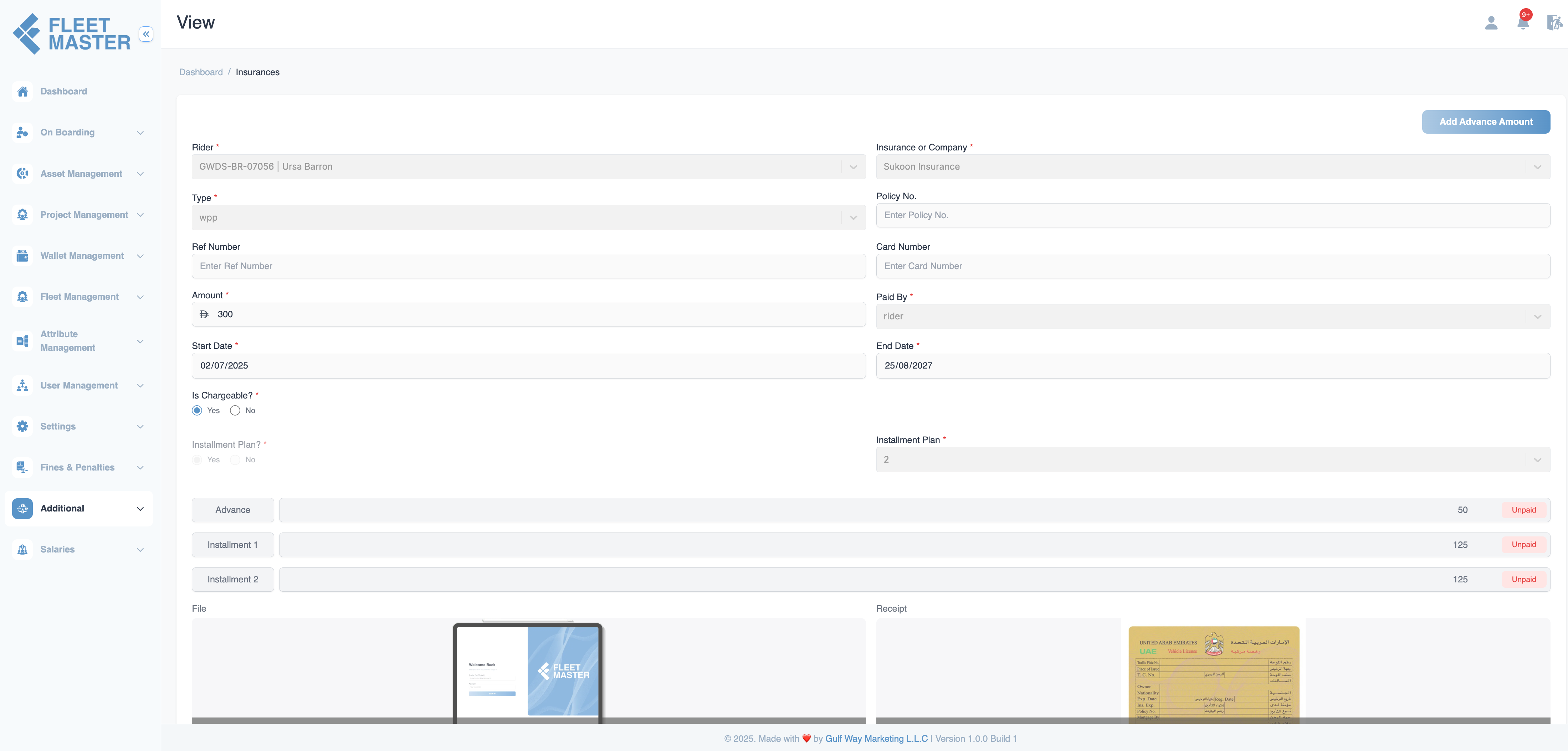

Insurance Transaction and Payment Flow

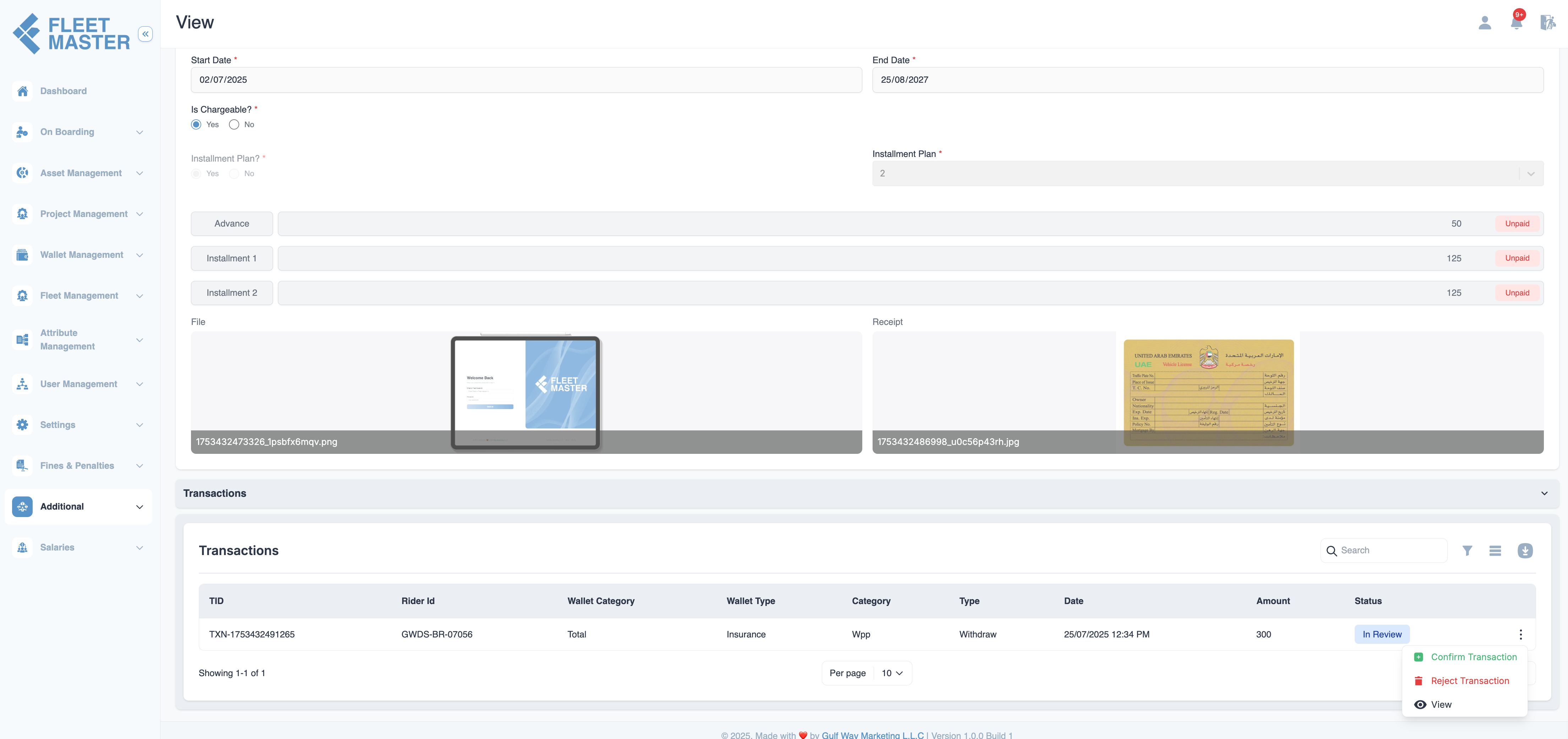

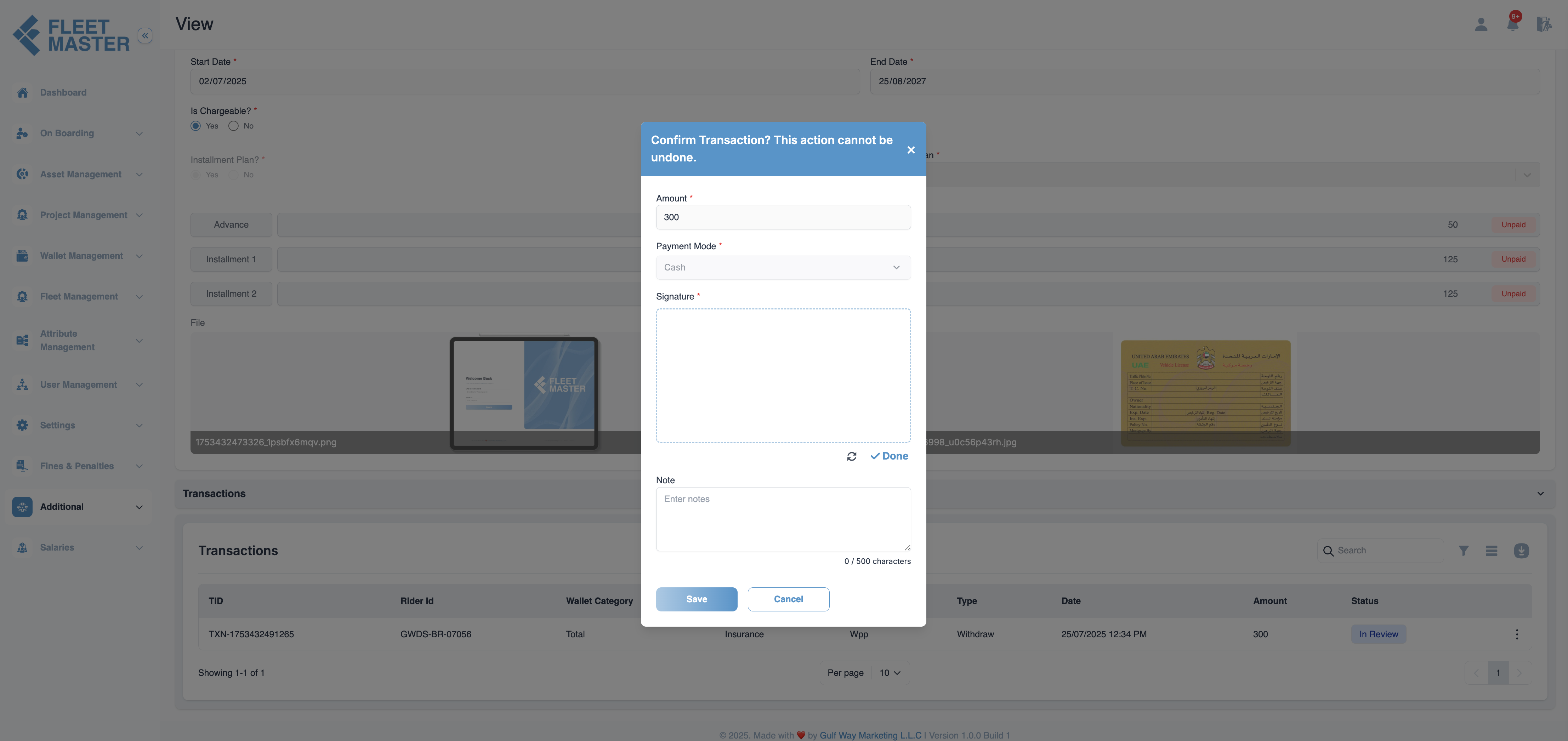

Step 1: Transaction Confirmation

- After creating an insurance entry, a Transaction is automatically created in the system.

- Admin Action Required:

- Navigate to the Transactions section.

- Confirm the Transaction before any further payment actions can be processed.

- The transaction must be in Confirmed status to proceed with any payments (advance or installments).

Important:

If the Transaction is not confirmed, no payments (advance or installments) will be processed.

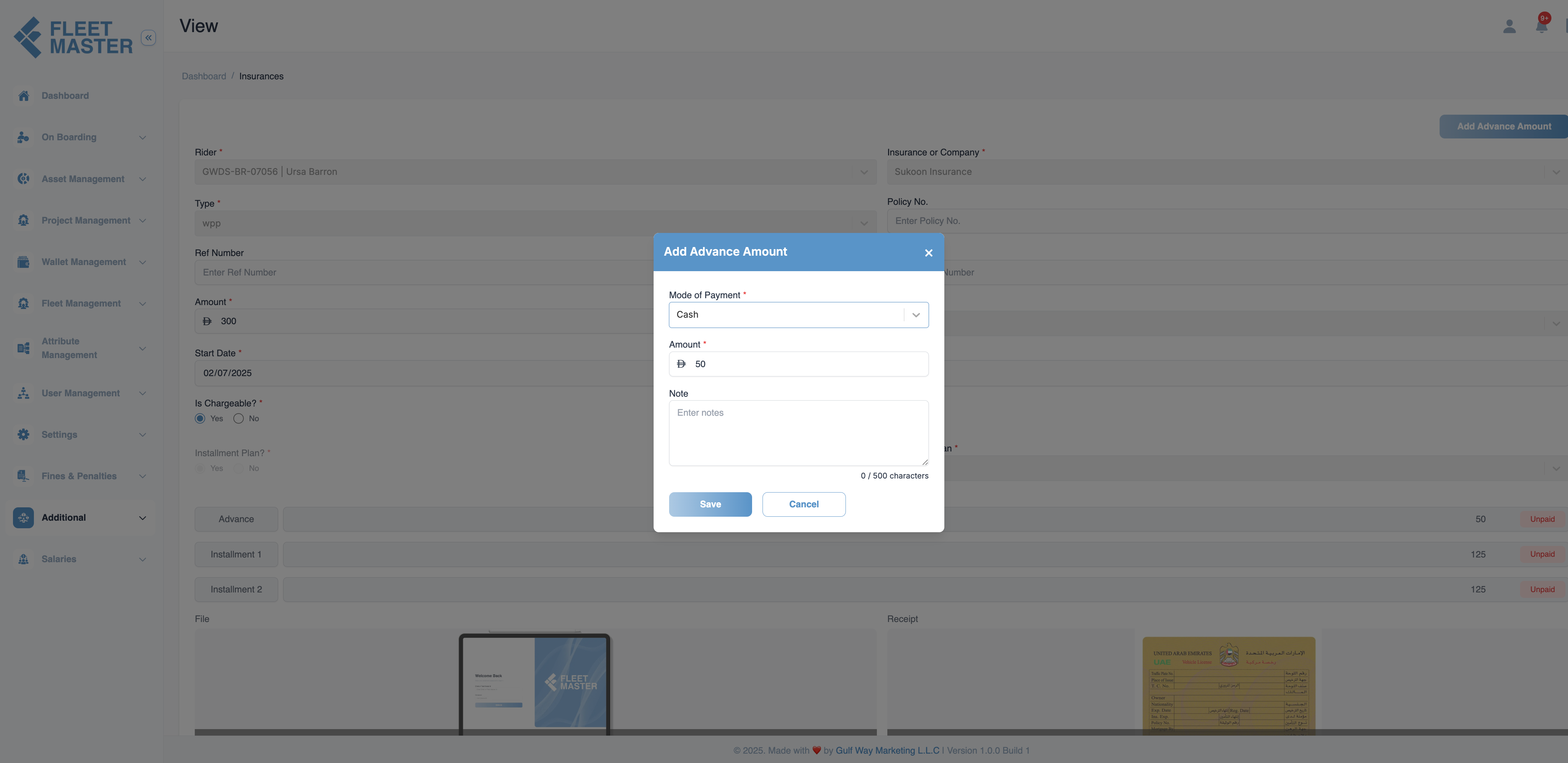

Step 2: Advance Payment

Once the transaction is confirmed, if the insurance has an advance amount:

- Navigate to the insurance entry page.

- If there’s an advance amount to be paid:

- The Pay Now option will be visible for the advance payment.

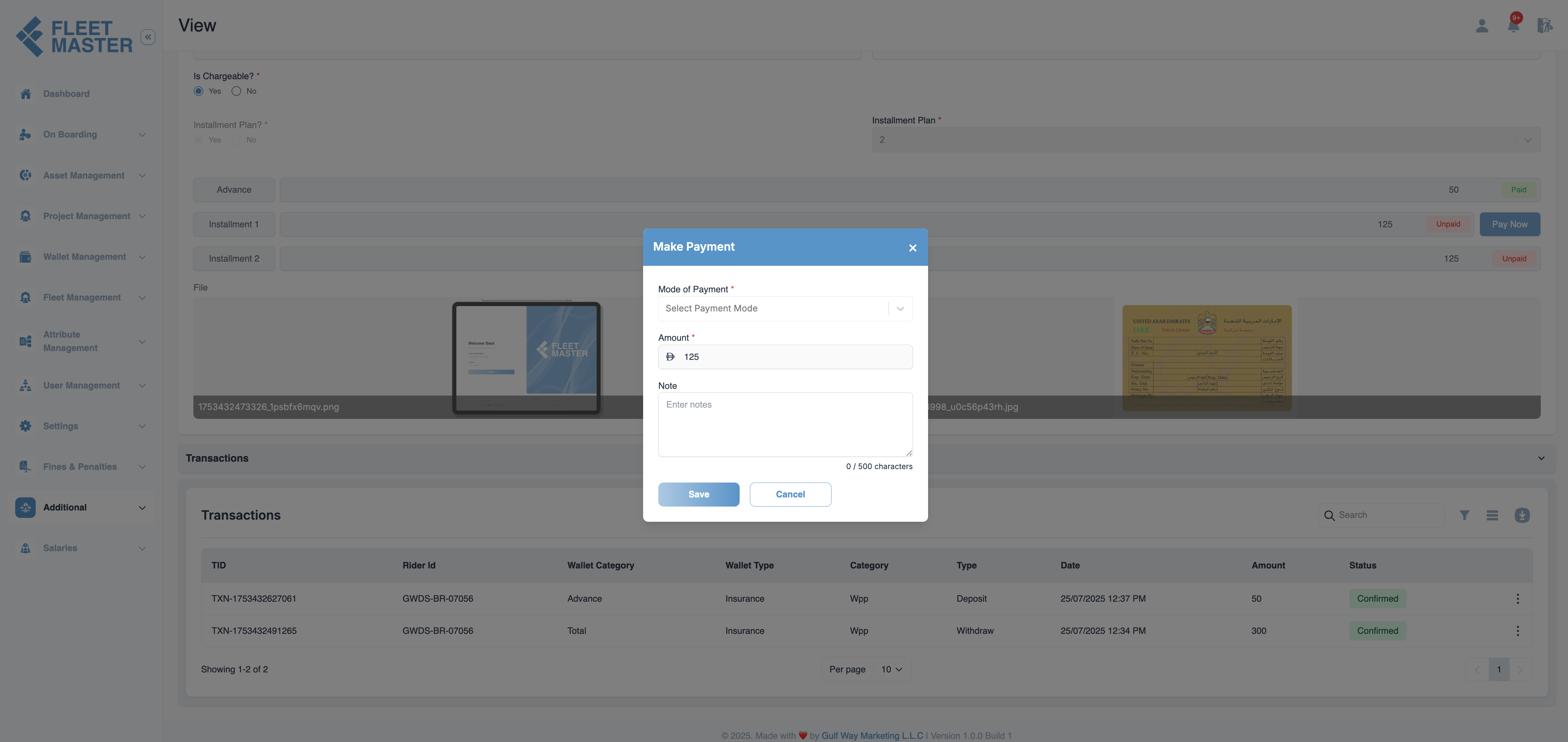

- Manual Advance Payment:

- Click Pay Now to pay the advance amount.

- A payment modal will appear, where the user can specify:

- Mode of Payment (Cash, Bank Transfer, etc.)

- Amount (pre-filled with the advance payment)

- Note (optional)

- Once the advance payment is successfully made, it enters In Review status.

- Admin Action Required: Confirm or reject the advance payment transaction in the Transactions section.

Tip:

If the advance payment is rejected, no further installments will be processed. Ensure proper confirmation of the advance payment.

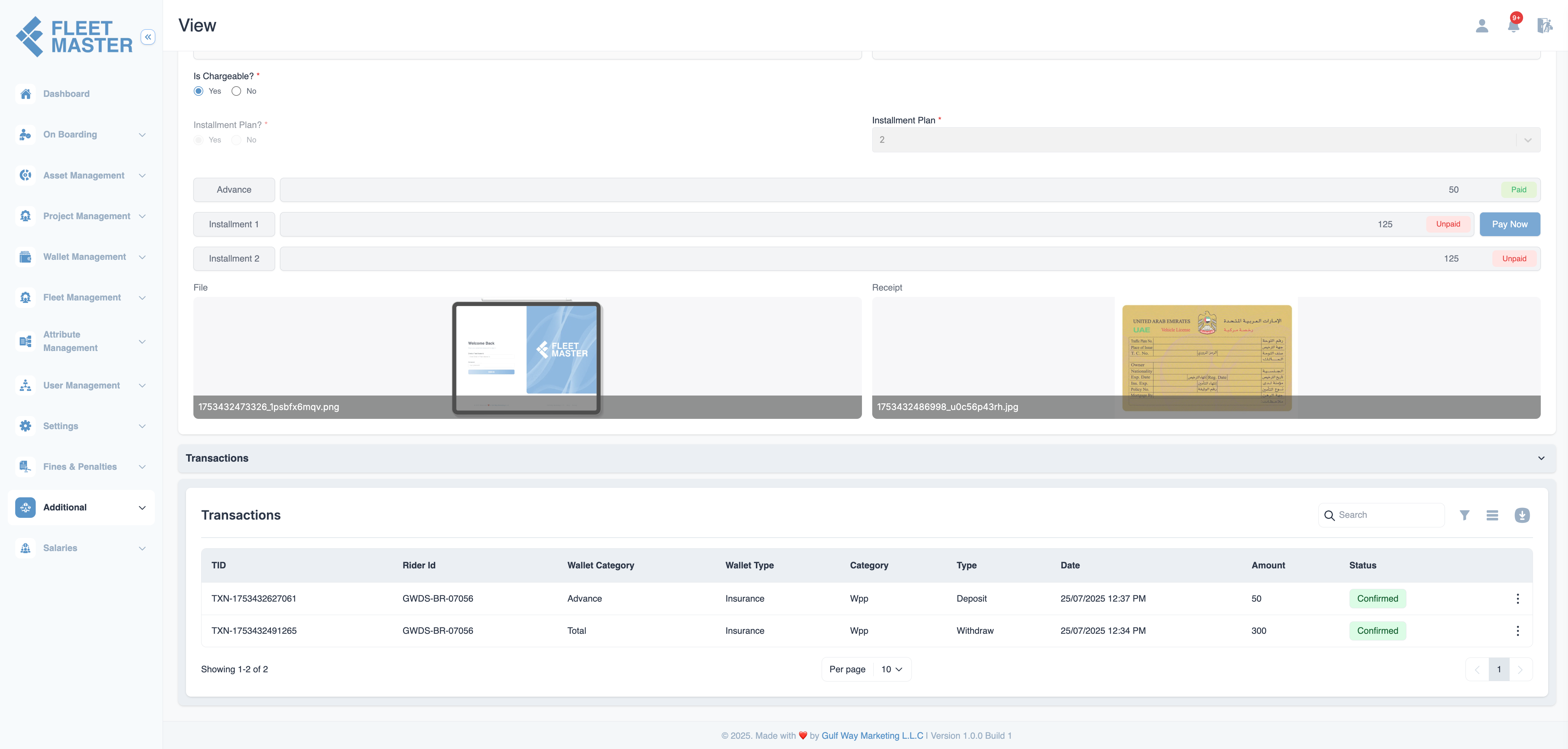

Step 3: Installment Payments

After the advance payment is confirmed, the system will:

-

Auto Deduct from Salary (for chargeable insurances):

- The installments will be automatically deducted from the fleet’s salary based on the pre-defined payment schedule.

- If the Installment Plan was chosen, the system calculates equal installment amounts and automatically applies deductions to the fleet’s salary.

-

Manual Payment Option (for non-chargeable insurance or manual overrides):

- If the fleet prefers to pay the installments manually, they can click Pay Now next to the relevant installment.

- A payment modal will appear with the installment amount pre-filled and payment method options (Cash, Bank Transfer, etc.).

- Once the payment is made, the installment status will be updated to In Review.

- Admin Action Required: Confirm or reject the installment payment in the Transactions section.

Editing Insurance Entry After Installments

Once the installment plan has been paid (either through salary deductions or manual payments), certain fields will be restricted from editing to maintain integrity in the financial record.

Restrictions After Payment:

- Insurance Type: Cannot be edited after the installment plan has been paid.

- Insurance Company: Cannot be edited after the installment plan has been paid.

Editable Fields After Payment:

- Amount: You can still edit the total amount if necessary.

- Paid By: You can update the payer information if needed.

- Note: Any remarks or additional information can still be updated.

- Start Date and End Date: These dates can be adjusted after payment confirmation.

- File and Receipt: Documents can be updated or replaced.

Transactions and Confirmation

- All advance and installment payments are tracked in the Transactions section.

- Admin Confirmation is required for each payment transaction.

- Confirm the Transaction before payments can be finalized.

- Transactions will remain in In Review status until confirmed or rejected by an admin.

Transaction Actions in the Admin Panel:

- Confirm: Finalizes the payment and updates the status.

- Reject: Cancels the payment and reverts the transaction.

- View: Opens detailed transaction information for review.

Payment Flow Example for Installments

-

Initial State:

- Installment 1: Pay Now button visible.

- Installment 2: No button (locked).

- Installment 3: No button (locked).

-

After Paying Installment 1:

- Installment 1: Paid status.

- Installment 2: Pay Now button visible.

- Installment 3: No button (locked).

-

After Paying Installment 2:

- Installment 1: Paid.

- Installment 2: Paid.

- Installment 3: Pay Now button visible.

Best Practices

- Transaction Confirmation: Always confirm transactions in the Transactions section before proceeding with payments.

- Advance Payments: Ensure that advance payments are confirmed before moving on to installment deductions.

- Installment Plans: Use installment plans for chargeable insurance to spread payments over time, and allow manual payments if preferred by the fleet.

- Track Payments: Regularly monitor and confirm both advance and installment payments to ensure accurate records.

- Editing Restrictions: After the installment plan is paid, insurance type and company cannot be edited. Only other fields like amount, paid by, and dates can be modified.

- Manual Payment Flexibility: Provide flexibility for manual payments if salary deduction isn’t preferred or applicable.

Flexibility Tip:

Dynamic add insurance companies in the Attribute Section provide maximum flexibility in managing various insurance plans across fleets.