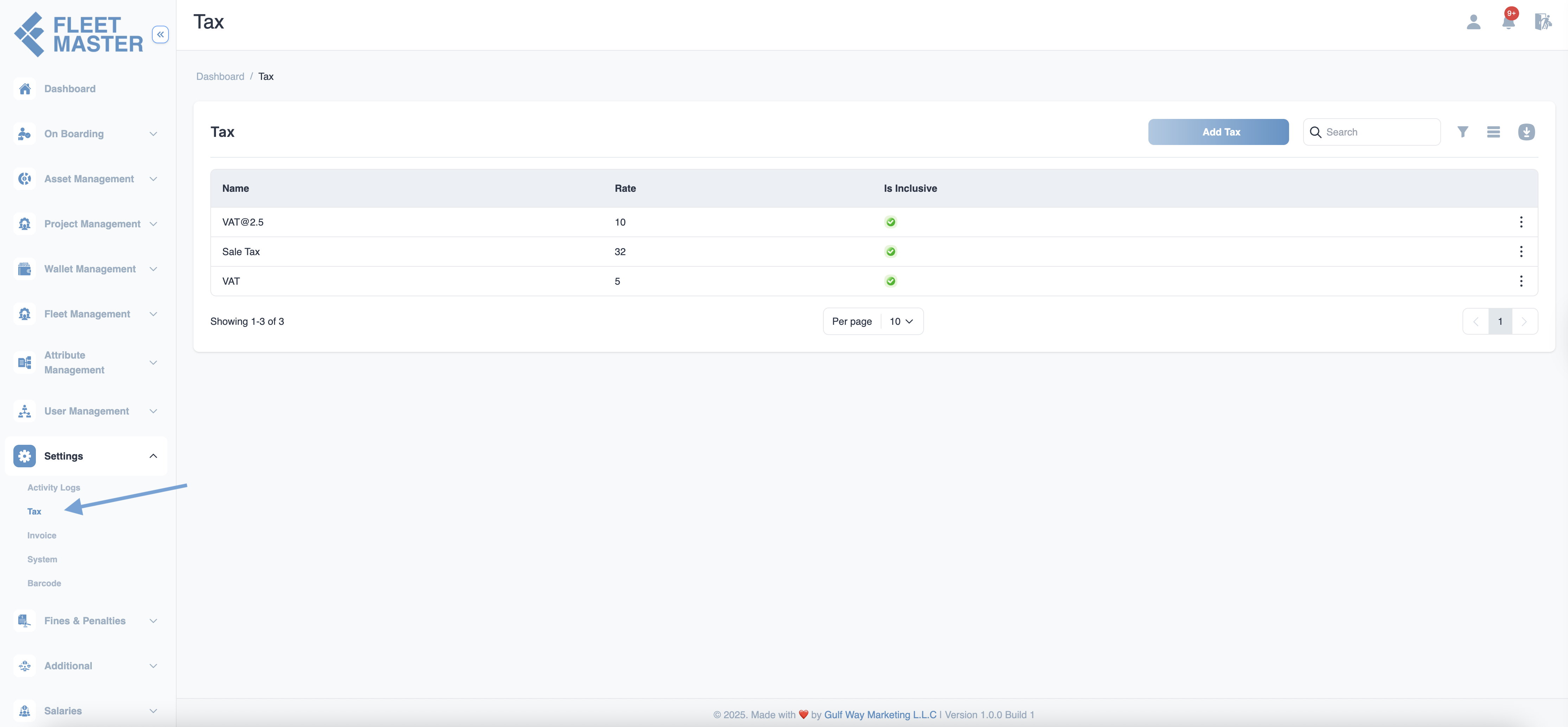

Manage Tax

The tax section in fleet master allows you to manage all tax types, including adding new taxes, editing existing ones, and removing those that are no longer needed. Below is the list of tax types already configured in the system.

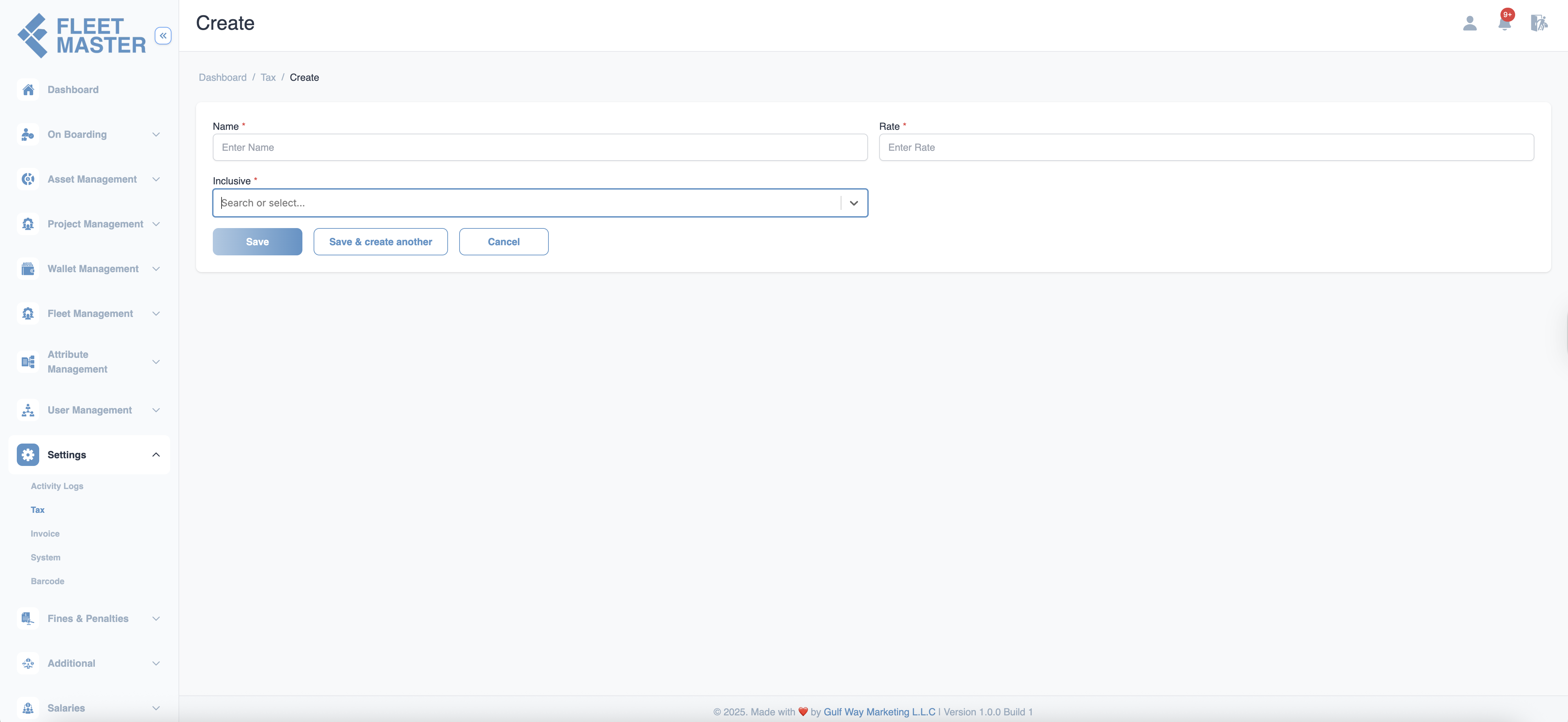

Adding a New Tax

To add a new tax, click on the Add Tax button. The Create Tax form includes the following fields:

-

Name:

Enter the name of the tax type (e.g., VAT, Sales Tax). (Required) -

Rate:

Enter the tax rate as a percentage (e.g., 5 for 5%). (Required) -

Is Inclusive:

Select whether the tax rate is included in the amount or should be added separately during calculations. (Required)- Yes: Tax is included in the final price.

- No: Tax is applied on top of the final price.

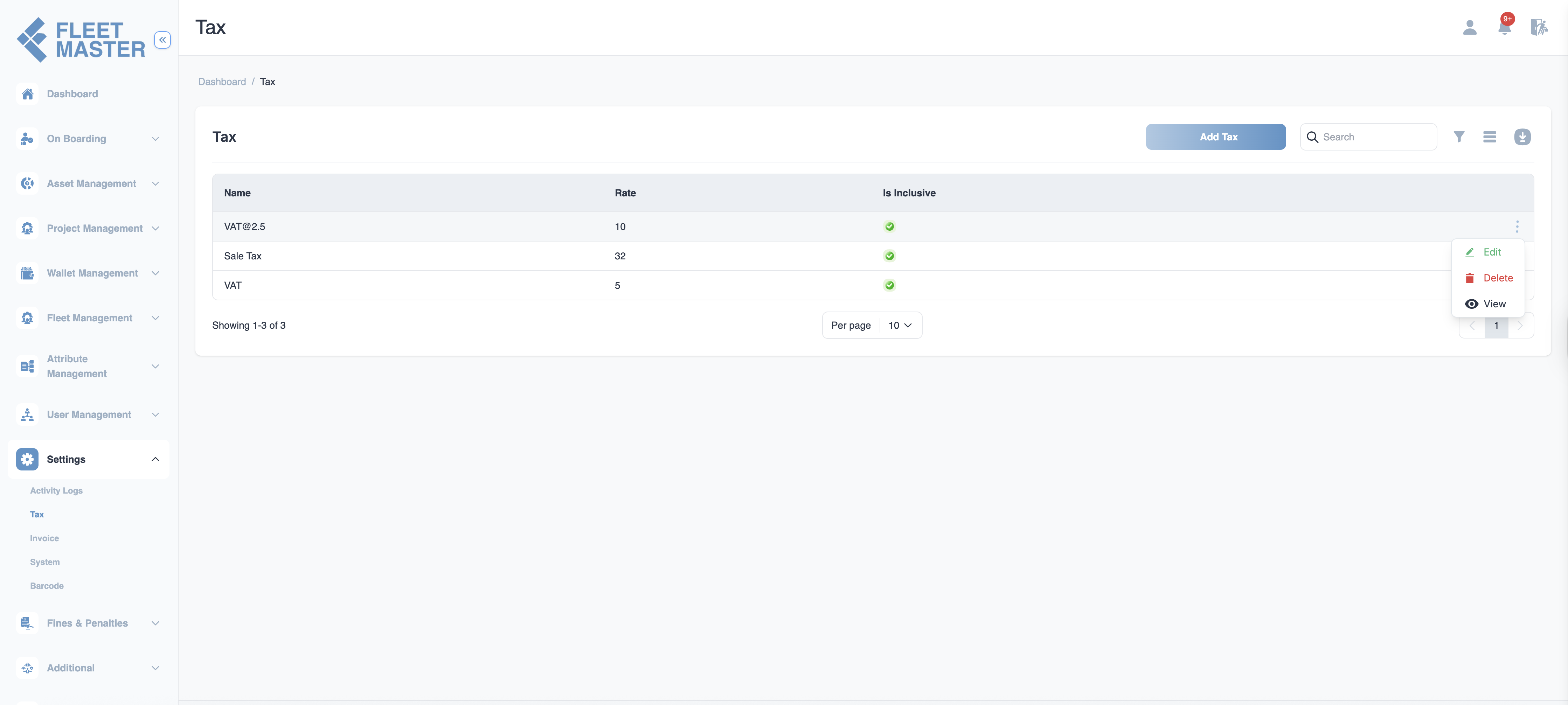

Editing & Deleting Tax

You can manage existing tax types by following these steps:

- Go to the Tax section.

- To edit a tax, click the Edit icon next to the tax entry. Update the tax details and save changes.

- To delete a tax, click the Delete icon to remove it from the system permanently.

Best Practice:

Ensure tax settings are updated in compliance with the latest regulations to avoid errors in financial reporting.

Best Practices

Tax Classification When adding new tax types, classify them correctly (e.g., Sales Tax, VAT) to ensure accurate calculations and reporting.

Rate Updates Tax rates may change based on regulatory changes, so it is crucial to keep the tax rates up-to-date. Set reminders for periodic rate checks.

Tax Inclusion Handling Always verify whether the tax is inclusive or exclusive before applying it in transactions to avoid discrepancies in total calculations.

Important:

Make sure to review the tax configuration periodically to ensure compliance with local tax laws and avoid penalties.

Maintenance Tip:

If tax laws change, remember to update your tax settings and notify the affected departments to prevent issues in invoicing.